The Diageo (LSE: DGE) share price has dropped 3.5% since the spirits company released its full-year results on 1 August. This drift downwards leaves the shares just above 52-week lows.

Is this now an opportunity to invest? Here are my thoughts.

Mixed results

For the 12 months up to the end of June, Diageo reported sales of £17.1bn. That was growth of 10.7% over the previous year. However, this sales growth was driven by price increases rather than volumes, which declined 0.8% on an organic basis.

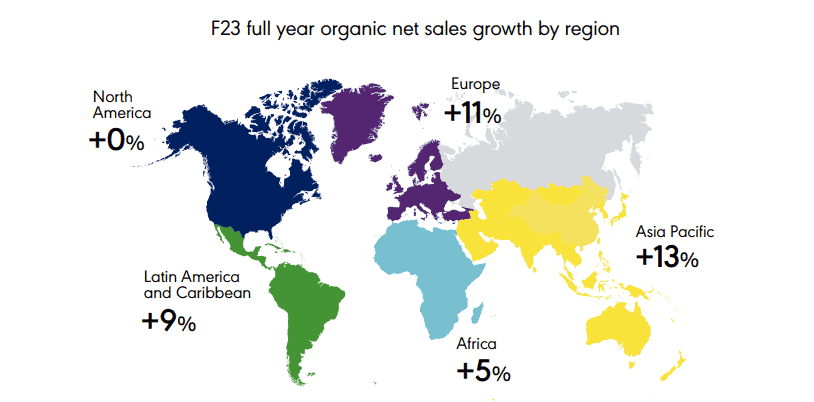

Below, we can see impressive headline growth across most regions, except for North America where spirits sales have stalled. Unfortunately, this is by far Diageo’s largest and most profitable market.

Now, this could be solely down to the tougher economic environment, with some consumers temporarily trading down their drinks. On the earnings call, new CEO Debra Crew euphemistically called this “smart shopping” by consumers.

But it could also signal something more worrying. It’s too early to tell yet. What is certain, though, is that competition cross the alcohol industry is intensifying.

Low barriers to entry

Nowadays, new celebrity-owned alcohol brands are popping up all over the place. And due to the incredible social media reach of most celebrities, some of these drinks become incredibly popular almost overnight.

So, while Diageo’s marketing spend has been increasing in recent years, these celebrities just go direct to potentially millions of consumers to promote their drinks. It costs next to nothing.

For example, mixed martial artist Conor McGregor founded Proper No. Twelve whiskey in 2018. And he now labels himself “Mr Whiskey” on social media, where he has more followers than all of Diageo’s 200 or so brands combined. Further, McGregor recently launched Forged, a new Irish stout that just made its debut in more than 350 Asda stores across the UK.

Of course, celebrity-backed drinks brands are not a new phenomenon. And Diageo has done a great job in the past of acquiring high-quality premium ones. In 2017, for instance, it bought Casamigos, the super-premium tequila brand co-created by George Clooney for $1bn. In 2020, it paid $610m for the Aviation gin brand co-owned by Hollywood actor Ryan Reynolds.

However, the incredible rate at which celebrities are creating spirits brands today is new. Bruno Mars, Jay-Z, Snoop Dogg, Kendall Jenner and Matthew McConaughey all own an alcohol brand. There are literally dozens more.

Collectively, this competition could chip away at Diageo’s market share, forcing it to spend more on marketing and expensive acquisitions.

A buying opportunity?

Alternatively, perhaps this could actually prove beneficial to Diageo. After all, when faced with a bewildering range of choice, most consumers do tend to default to trusted brands. Coca-Cola‘s longevity is a great example of this, and Diageo’s flagship premium brands are still doing well.

Personally, I’d be surprised if Guinness and Johnnie Walker aren’t still incredibly popular around the world in a couple of decades’ time. Will their celebrity-backed competition even be around then? Nobody knows.

Therefore, I see the share price dip as a long-term buying opportunity. But when I buy more shares, I’ll be keeping a close eye on Diageo’s market share to make sure its competitive moat isn’t deteriorating.